What is the Bail Out Banks?

In the world of finance, the term “bail out banks” has been making headlines for years. But what exactly does it mean? Simply put, a bail out refers to the act of providing financial assistance to a struggling bank or financial institution to prevent its collapse. The goal is to prevent a widespread economic crisis and maintain stability within the financial system. This intervention can come in the form of government funds, loans, or guarantees to help the bank stay afloat during tough times.

History of Bail Out Banks

Bail out banks have a long and complex history dating back to the Great Depression in the 1930s. During this time, numerous banks failed, causing a devastating economic downturn. In response, the US government established the Reconstruction Finance Corporation (RFC) to provide financial assistance to struggling financial institutions. This marked the beginning of bail out banks as we know them today.

Over the years, bail out banks have played a significant role in stabilizing the financial industry during times of crisis. From the savings and loan crisis of the 1980s to the global financial crisis of 2008, governments around the world have implemented various bail out measures to prevent the collapse of major banks and protect the economy. https://cpcgrow.com/

Reasons for the Establishment of Bail Out Banks

The establishment of bail out banks can be attributed to several key reasons. Firstly, the interconnected nature of the global financial system means that the failure of one bank can have far-reaching consequences. A single bank’s collapse can trigger a domino effect, leading to the collapse of other financial institutions and a severe economic downturn. Bail out banks aim to prevent this chain reaction and maintain stability within the financial system.

Secondly, banks play a vital role in the functioning of the economy. They provide loans, facilitate transactions, and support economic growth. When banks face financial difficulties, the availability of credit can dry up, leading to a credit crunch and hampering economic activity. Bail out banks aim to ensure that the flow of credit remains uninterrupted, supporting the overall health of the economy.

How Do Bail Out Banks Work?

When a bank is on the verge of collapse, the government or relevant authorities step in to provide financial assistance. This assistance can take different forms depending on the severity of the situation and the specific circumstances. In some cases, the government may inject capital into the bank, effectively becoming a shareholder and helping the bank meet its capital requirements. This infusion of funds helps the bank strengthen its balance sheet and continue its operations.

In other cases, the government may provide loans or guarantees to the struggling bank. These loans can help the bank meet its short-term liquidity needs and restore confidence among depositors and investors. Guarantees, on the other hand, provide assurance to creditors that they will be repaid even if the bank fails. These measures aim to stabilize the bank’s operations, restore market confidence, and prevent a run on the bank.

Examples of Bail Out Banks Around the World

Bail out banks have been implemented in various countries around the world. One notable example is the Troubled Asset Relief Program (TARP) in the United States. During the 2008 financial crisis, the US government authorized the allocation of $700 billion to assist struggling banks and stabilize the financial system. This included capital injections into major banks, such as Bank of America and Citigroup, to prevent their collapse.

In the United Kingdom, the government implemented a similar program known as the Financial Services Compensation Scheme (FSCS) during the global financial crisis. The FSCS provided guarantees and protection for depositors, ensuring that their funds were safe even if a bank failed. This measure helped restore confidence in the banking sector and prevent a widespread run on banks.

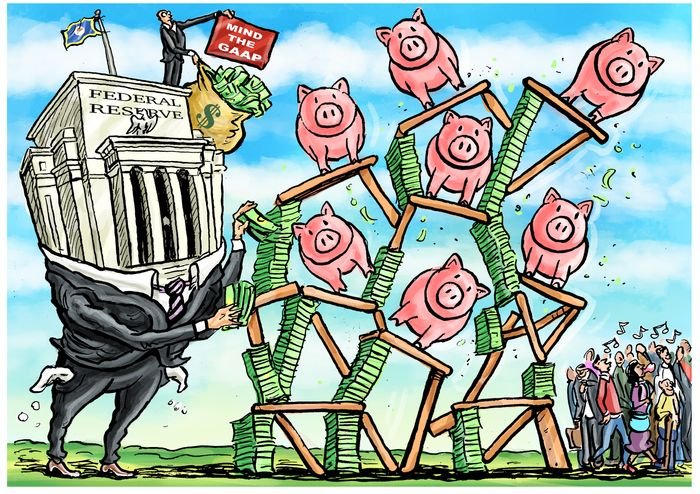

Criticisms and Controversies Surrounding Bail Out Banks

Bail out banks have been a subject of intense scrutiny and debate. Critics argue that these measures create moral hazard by incentivizing banks to take excessive risks, knowing that they will be bailed out if things go wrong. This can lead to a culture of recklessness and irresponsible behavior within the banking industry.

Moreover, bail outs often involve the use of taxpayer money. This raises concerns about the fairness and equity of using public funds to rescue private financial institutions. Critics argue that this places an undue burden on taxpayers and rewards banks for their failures.

Pros and Cons of Bail Out Banks

Despite the criticisms, proponents argue that bail out banks are necessary to prevent further economic damage. They believe that the collapse of a major bank can have catastrophic consequences for the economy, leading to widespread unemployment, loss of wealth, and a deep recession. Bail out banks provide a lifeline to struggling institutions, protecting jobs, and supporting economic stability.

However, it is important to strike a balance between providing assistance and ensuring accountability. Proponents emphasize the need for stricter regulations and oversight to prevent abuse and ensure that banks are held responsible for their actions. This includes measures such as increased capital requirements, stress tests, and improved risk management practices.

The Impact of Bail Out Banks on the Economy

The impact of bail out banks on the economy is a complex and multi-faceted issue. On one hand, these measures can help prevent a widespread financial crisis and maintain stability within the financial system. By providing financial assistance to struggling banks, bail outs can help restore market confidence, maintain the flow of credit, and support economic growth.

However, bail out banks can also have unintended consequences. Critics argue that these measures can create a moral hazard by rewarding banks for their risky behavior. This can lead to a cycle of bail outs, where banks continue to take excessive risks, knowing that they will be rescued if things go wrong. Over time, this can erode market discipline and undermine the stability of the financial system.

Government Regulations and Oversight of Bail Out Banks

In response to the criticisms and controversies surrounding bail out banks, governments have implemented stricter regulations and oversight measures. The goal is to prevent abuses, ensure accountability, and minimize the risk of future financial crises.

These regulations include increased capital requirements, stress tests, and improved risk management practices. Banks are now required to hold higher levels of capital to absorb potential losses and reduce their reliance on government assistance. Stress tests are conducted to assess the resilience of banks’ balance sheets and their ability to withstand adverse economic conditions.

Conclusion: The Future of Bail Out Banks

The future of bail out banks is a topic of ongoing debate and discussion. While these measures have been instrumental in stabilizing the financial system during times of crisis, there is a growing recognition of the need for better regulation and accountability.

Moving forward, it is crucial to strike a balance between providing assistance to struggling banks and ensuring that they are held responsible for their actions. Governments must continue to implement robust regulations and oversight measures to prevent abuse and maintain the stability of the financial system.

In conclusion, bail outbanks play a vital role in preventing widespread economic crises and maintaining stability within the financial system. However, their implementation must be accompanied by strict regulations and oversight to ensure that banks are held accountable and prevent a culture of moral hazard. By striking this balance, we can harness the benefits of bail outbanks while minimizing the risks associated with them.